It's a few months old but good video from John Titus explaining the situation of "unsustainable" US debt and future of CBDCs:

"The Unholy Trinity of the U.S.—the Federal Reserve, BlackRock and the U.S. Treasury—all concur: it’s lights out for the U.S.

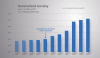

Unsustainable debt levels, check.

Runaway inflation, check.

Imminent loss of world reserve currency status, check.

These are the consequences of entrenched deficits, according to the criminal powers that be, as reflected in their documents and testimony.

What’s so astonishing about the imminent loss of world reserve currency status by the U.S. dollar is that the foregoing opinions were rendered BEFORE the Federal Reserve itself confirmed for all the world to see that the U.S. has no rule of law at all, but is instead ruled by out-of-control bankers who acted on what will prove to be a fatal whim by freezing Russian reserves without so much as the pretense of due process; the Fed just upped and did it, despite the fact that all monetary instruments in the U.S., regardless of who they belong to, are legal instruments.

Incredibly, the same Fed Chairman who presided over this idiocy then turned around and testified before congress that world reserve currency status HINGES ON the very thing he just destroyed, which was the rule of law.

And yet throughout this entire nuclear clown show, nowhere in any official discussion of what ails the U.S. does one find any discussion whatsoever of the

actual root of the problem, to wit, a monetary system in which the nation-state host is now borrowing money from its lead parasite (the Fed) at interest, as opposed to bypassing that tapeworm and issuing money itself, ever addressed. Instead, the Unholy Trinity freely opines that the only remedy for the country’s ills is to work enormous austerity and tax increases on its inhabitants. The good doctors, in other words, are telling the stage 4 cancer patient that his only hope now is to subject himself to the massive atrophy of chemo treatments, but with the cancer itself shielded off from the radiation.

Meanwhile, the sedated patient is subjected to the full-on looting by more QE (inevitable) and a wild array of grotesque distractions, not one of which has the slightest chance of changing the inevitable outcome of the U.S. debt-based monetary system from its inevitable demise now that the country is past the point of no return with debt levels.

These and other cheerful topics are discussed herein."